child tax credit november 2021 direct deposit

We dont make judgments or prescribe specific policies. Single parents earning up to 75000 a year and couples earning up.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

By Dan Clarendon.

. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for children under the age of 6 and to 3000 per child for children ages 6 through 17. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each.

If they filed a tax return in 2019 or 2020 and had direct deposit the family started receiving the first 3300 of the credit in six monthly payments of 550 from July to December. It will take the state until early October to print all. Missing Advance Child Tax Credit Payment.

Updated for Tax Year 2021 November 8 2021 0146 PM. IR-2021-222 November 12 2021. According to the IRS some 39 million families.

The tax credit provides families with 3600 total per child under age 6 and 3000 total per child ages 6 to 17. Those eligible for the expanded 2021 child tax credit will see between 250 and 300 a month for each child in the household. Eligible families with children 17 years old or younger will get their first Child Tax Credit payments by direct deposit.

Most parents automatically get the enhanced credit of up to 300 for each child up to age 6 and 250 for each one ages 6 through 17. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. 13 2021 Published 330 pm.

Before this year the refundable portion of the. Thats less generous than the enhanced CTC and. The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Claim the Tax Refund You Deserve. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon. 16 2021 The Treasury Department said families with roughly 61 million eligible children received more than 15 billion in the fifth batch of Advance Child Tax Credit.

The IRS is scheduled to send the final. 15 as well as quarterly payroll and excise tax returns normally due on Aug. See what makes us different.

November 12 2021 1226 PM CBS New York. The combined payments -- 325 for individuals or 650 for married couples filing jointly -- will be included in one paper check. The CTC in 2021 is a fully refundable tax credit meaning that eligible families can receive it even if they owe no federal income tax.

The last payment for 2021 is scheduled for Dec. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Get Help maximize your income tax credit so you keep more of your hard earned money. Ad Tips Services To Get More Back From Income Tax Credit. Ad File to Get Your Child Tax Credits.

For 2021 eligible parents or guardians can receive up to 3600 for each child who. If Congress doesnt extend it the Child Tax Credit would revert to its pre-2021 level or 2000 for each child under the age of 17.

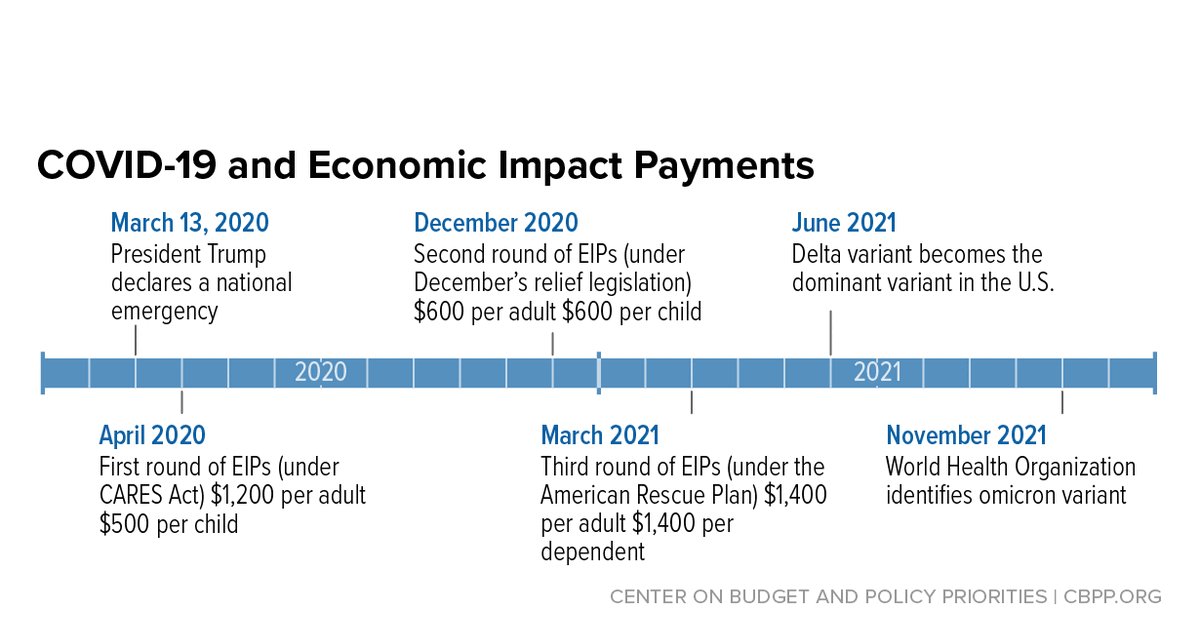

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit Ctc Get Your Payment Il

Child Tax Credit Monthly Payments To Begin Soon The New York Times

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Childctc The Child Tax Credit The White House

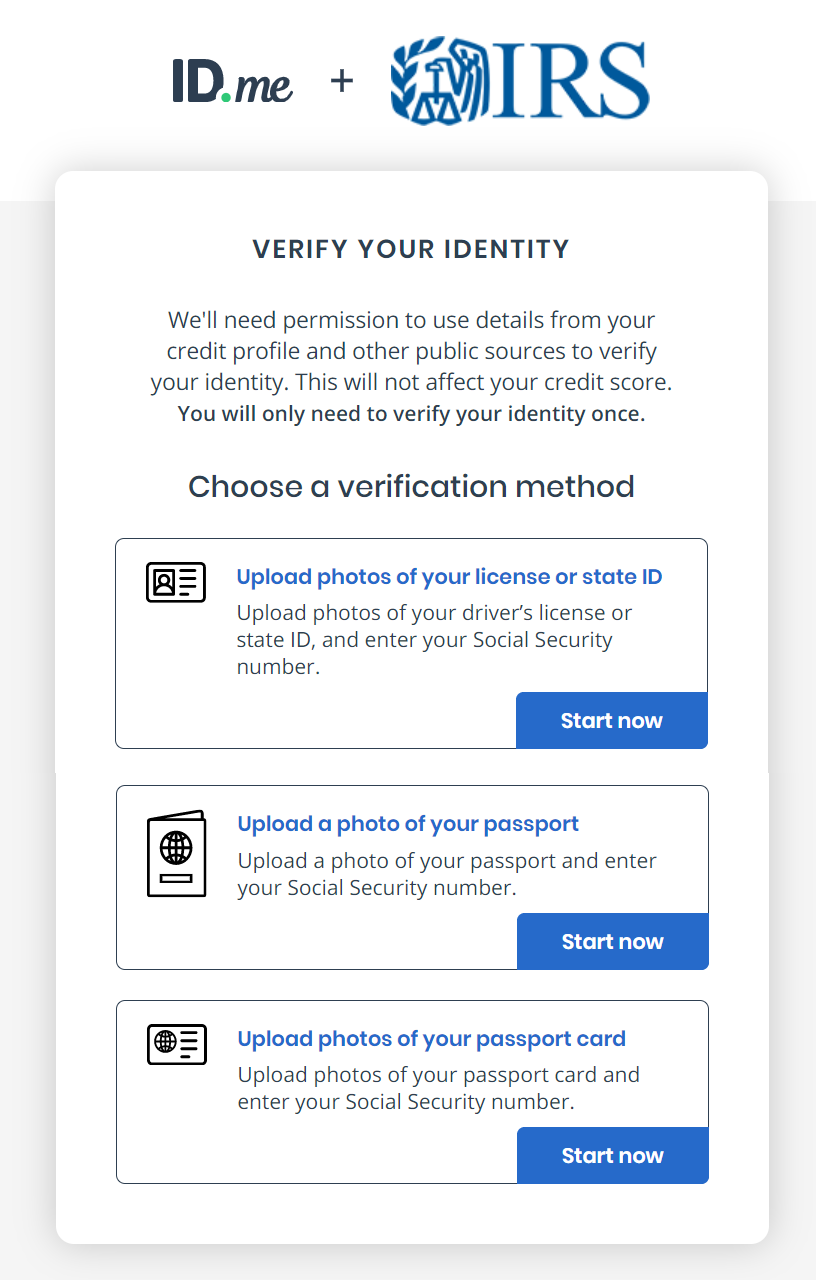

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Schedule 8812 H R Block

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

Is Your Family Eligible For The Child Tax Credit Payments Legal Aid Of Nebraska

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back